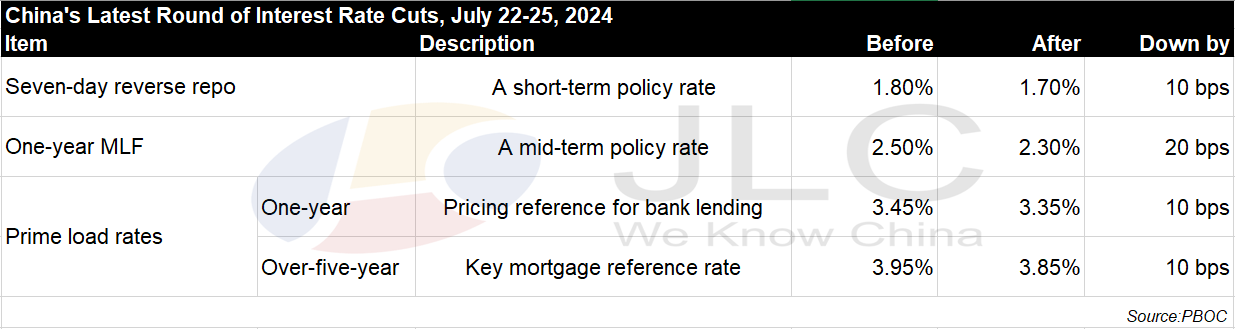

*PBOC cut key policy rates on the heels of the Third Plenum;

*Seven-day reverse repo was down by 10 basis points to 1.70%;

*One-year MLF was down by 20 basis points to 2.30%;

*LPRs were cut by 10 basis points;

*Commercial banks also cut deposit interest rates.

Guangzhou (JLC), July 25, 2024 – The People’s Bank of China (PBOC), China’s central bank, has cut some key policy interest rates since July 22, a move seen as parts of the latest efforts to boost the economy after the conclusion of the third plenary session of the 20th Central Committee of the Communist Party of China (known as the “Third Plenum”).

The cuts, ranging from 10 to 20 basis points, involved the seven-day reverse repurchase (reverse repo) and one-year medium-term lending facility (MLF), which serve as the short-term and medium-term policy rate, respectively.

Loan prime rates (LPRs), which serve as the country's market-based benchmark lending rates, also dropped by 10 basis points.

Meanwhile, major commercial banks – including the “big-four”, namely the Industrial and Commercial Bank of China (ICBC), Agricultural Bank of China (ABC), Bank of China (BOC), and China Construction Bank (CCB) – also announced on Thursday that they cut deposit interest rates by up to 20 basis points.

Details of a range of cuts

On July 22, the PBOC lowered the interest rate on seven-day reverse repos to 1.7%, a cut of 0.1% or 10 basis points.

A reverse repo is a process in which the central bank purchases securities from commercial banks through bidding, with an agreement to sell them back in the future. A reverse repo will potentially inject more liquidity into the market.

On the same day, the one-year LPR was lowered by 10 basis points to 3.35%, while the five-year LPR – the benchmark for mortgages – was reduced by the same margin to 3.85%.

The LPRs are calculated by the National Interbank Funding Center (NIFC), serving as the pricing reference for bank lending, the PBOC said on its website.

On July 25, the PBOC also pumped CNY200 billion into the market via the MLF, which will mature in one year at an interest rate of 2.3%, 20 basis points lower than the previous level.

The MLF was introduced in 2014 to help commercial and policy banks maintain liquidity by allowing them to borrow from the central bank using securities as collateral.

Also on July 25, some of China's major commercial banks including ICBC, ABC, BOC and CCB announced a reduction in deposit interest rates by up to 20 basis points, the Beijing News reported.

The one-year, two-year, three-year, and five-year deposit rates from the “big-four” commercial banks was lowered to 1.35%, 1.45%, 1.75%, and 1.80%, respectively.

Monetary policy, first to move

The moves made by the PBOC and major state-backed commercial banks were among the latest efforts made by the country to rejuvenate the economy, given the fact the Q2 GDP grew slower than expected.

The interest rate cuts, especially those for corporate loans, mortgages and deposits, are expected to help further reduce the burden on the economy and stimulate effective demand, market sources said.

More policies are expected in order to boost the economy after the Third Plenum, as more stimulus will be needed if the government is to attain the annual growth target of around 5%.