Guangzhou (JLC), May 20, 2024 – China has recently announced various measures to boost its property sector, officials said at a press conference held by the State Council on May 17.

The measures came at a time when the housing market remained a major drag on the country’s growing economy.

China’s property investment fell 9.8% year on year to CNY3.09 trillion in January-April 2024, according to the National Bureau of Statistics (NBS). New property sales volume decreased 20.2% yoy to 293 million square meters in the first four months of 2024, the NBS data showed.

China’s Property Development Index, a gauge of the sector's level of prosperity, stood at 92.02 in April, the lowest level in more than a year.

To pull the sector out of the doldrums and revive developers’ and home-buyers’ confidence, the authorities announced the following stimulus measures, including but are not limited to:

Lower down-payment ratios

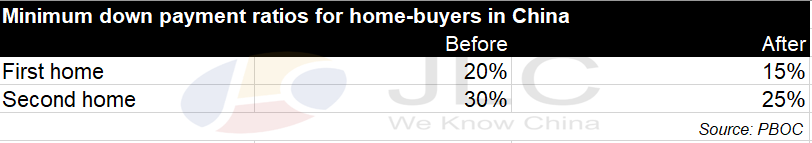

The minimum down payment ratios for individuals' commercial home mortgages will be lowered to 15% for first-home buyers and 25% for second-home buyers, said Tao Ling, Deputy Governor of the People's Bank of China (PBOC), China’s central bank.

No floors on commercial mortgage rates

The PBOC also announced that lower limits of commercial mortgage rates for first and second homes will be removed across the country.

Central bank branches can determine the lower limits of commercial mortgage rates in accordance with local conditions, and financial institutions should set the floor lending rates based on their business status and their borrowers’ risk assessment, the central bank said.

Lower interest rates on housing fund loans

China also cut the loan rates of the individual housing provident fund (“housing fund”), a long-term housing savings plan made up of compulsory monthly deposits by both employers and employees, by 0.25 percentage points, effective May 18, the PBOC said.

Compared to a commercial mortgage, a housing fund loan itself generally enjoys a lower interest rate.

Relending fund for purchasing unsold homes

China has recently given the green light to local state-owned enterprises (SOEs) to buy some unsold residential projects and turn them into affordable public housing.

The PBOC announced a CNY300 billion relending fund, which will be provided to 21 commercial banks. This measure is expected to release CNY500 billion in bank loan liquidity through these banks to local SOEs to purchase unsold homes.

Other steps to support unfinished projects

In addition, the National Financial Regulatory Administration announced on May 17 that the country will actively provide lending support to those unfinished housing projects on the “white list”, regardless of the ownership of their developers.

Under the “white list” program launched in January, local governments nominated the unfinished housing projects, for which banks were encouraged to provide loans.

This policy was deemed to be targeted at specific projects, rather than developers.

Easing of home-buying restrictions

Many second-tier or third-tier cities have relaxed or lifted their home-buying curbs over the past a couple of years to spur home sales.

Xi’an, Hangzhou, Dongguan, Foshan, Wuhan, Dalian, Qingdao, Jinan, Xiamen, Nanjing, Nanchang, Fuzhou, Zhengzhou were among those cities that eased or lifted home-buying restrictions.

First-tier cities – Beijing, Shanghai, Guangzhou and Shenzhen – also fine-tuned their home-buying policies. However, the “big-four” cities have not totally scrapped home-buying restrictions.